The Cold Hard Truth About Data Quality

Building an identity graph is not a process that happens overnight. It requires years of gathering data sources, defining linkage, then the most important step — verification and cleaning for accuracy.

So what is the difference between AudienceLab data and everyone else? Why pay more for an intent list when someone can get it for $50 on Fiverr?

There Are 2 Types of

Data Companies

Understanding this distinction is the single most important thing you can do before choosing a data partner.

Identity Graphs

Derivative Data Resellers

Where Do DDRs

Get Their Data?

Major identity graphs do not usually work in small amounts. Most require annual commitments at $250,000 to $1M+ just for access — and even more to license it.

This means in order to buy access, a data reseller needs to purchase a "derivative" dataset that has been watered down enough to be classified as a different product.

Experian has a core dataset retailing at $3M–$5M/year. The mobile numbers from this raw consumer data may be used in a co-reg dataset so it is officially a "derivative product" and can be sold separately.

But here's the problem — the data quality goes down with every derivative and every new build. The decay is rapid.

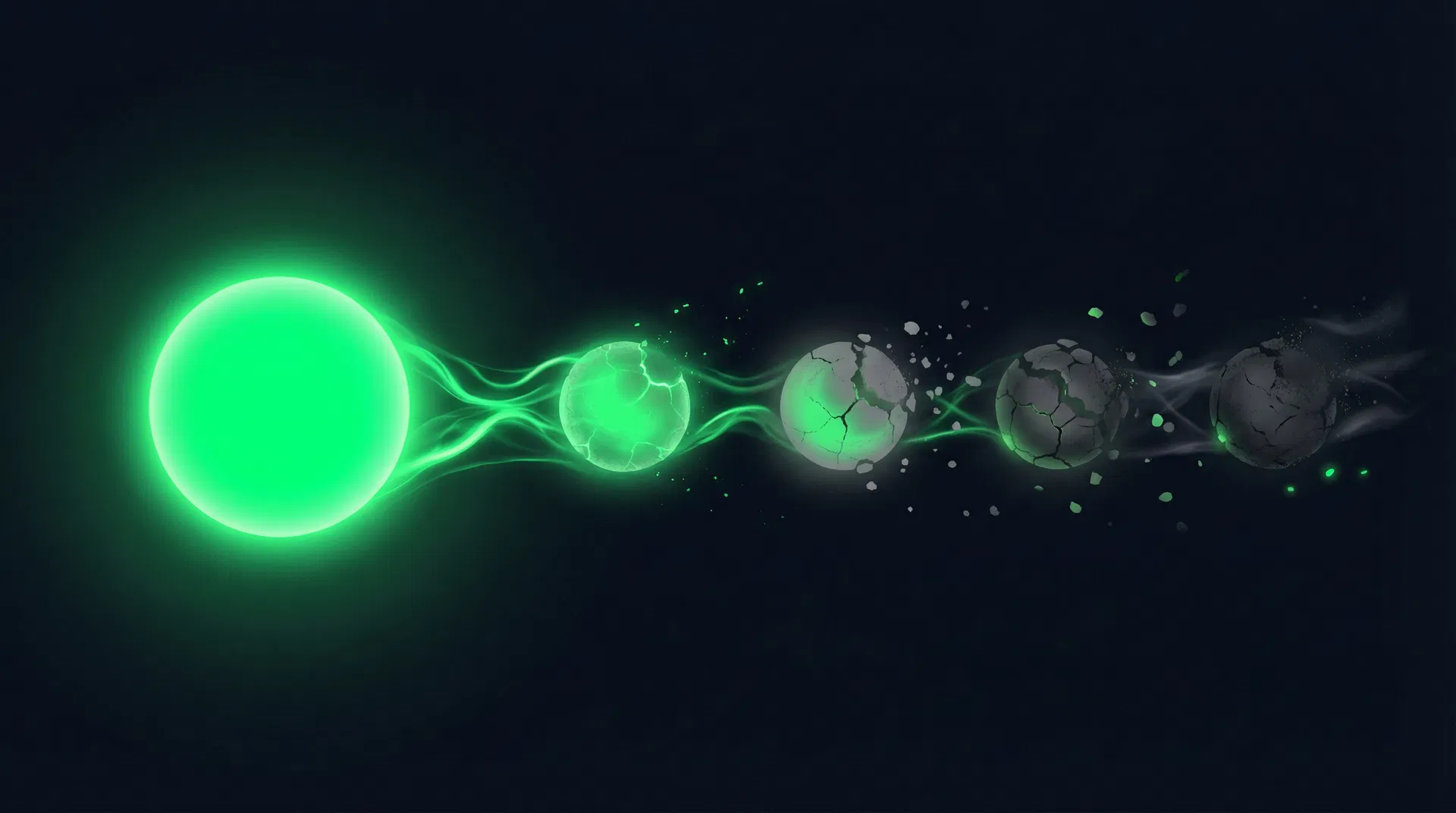

The Accuracy Waterfall

Data quality degrades with each derivative build

This is the core difference between a core dataset worth millions of dollars and one you could grab on Fiverr for $50. It's all about provenance — being as close to the source file as possible.

Very Few Companies Track

Data Provenance

Very few data companies do the due diligence to track the provenance of the dataset and make sure they have the real source — not a derivative.

Derivative datasets have the same labels but often contain data from dozens of different sources — only 10% of which are verifiable.

Derivative Reseller vs.

Original Identity Graph

The upfront price of derivative data looks cheaper. But when you factor in cleaning, verification, match rates, and wasted spend — the true cost tells a different story.

Consumer-Base Accuracy & Data Decay

Consumer data decays at roughly 2-3% per month. Source-level identity graphs refresh continuously. Derivative builds are snapshots that age rapidly, compounding the accuracy loss from being a derivative in the first place.

Email Validation

Even if an email address is 'valid' (deliverable), it may not belong to the right person. Derivative datasets often have mismatched email-to-person linkages because the original linkage was lost in the derivative process.

Probabilistic Matching Without Guardrails

Many DDRs use probabilistic matching to fill gaps in their derivative data. Without the original deterministic linkage, they guess — and those guesses compound errors across every record.

Contact Data Accuracy

Phone numbers, job titles, and company associations change constantly. Source-level graphs track these changes. Derivatives inherit stale data from the moment they're created.

Intent Data False Negatives

When your contact data is wrong, your intent signals are wrong. You're not just missing leads — you're building campaigns on phantom signals from people who don't exist at those companies anymore.

How Do These Numbers

Make Sense?

Let's walk through the actual cost to clean and verify data so it's usable — and the realistic identity match rates when you're working off derivatives.

Consumer-Base Accuracy & Data Decay

Consumer data decays 2-3% monthly. A derivative dataset that starts at 60% accuracy can drop below 40% within 6 months — with no refresh pipeline.

Email Validation

"Valid" only means deliverable. It does not mean the email belongs to the right person. Derivative datasets lose the email-to-identity linkage that makes the data actionable.

Probabilistic Matching Without Guardrails

DDRs use probabilistic matching to fill gaps. Without deterministic anchors, every guess compounds errors — turning a 60% dataset into a 40% one after matching.

Contact Data Accuracy

Phone numbers, job titles, and company associations change constantly. Source graphs track changes in real-time. Derivatives inherit stale data from the moment they're created.

Intent Data False Negatives

Wrong contact data means wrong intent signals. You're not just missing leads — you're building campaigns on phantom signals from people who don't exist at those companies anymore.

We Track Provenance.

We Verify at the Source.

AudienceLab was built from the ground up as an identity-first platform. We don't resell derivative datasets. We source, link, verify, and continuously refresh our data — so you get accuracy that derivative resellers simply cannot match.

The Full Comparison

| Factor | Identity Graph | DDR / Derivative |

|---|---|---|

| Data Source | Owned & managed in-house | Resold / white-labeled API |

| Base Accuracy | 95-98% | 33-60% |

| Refresh Rate | Continuous / monthly | Snapshot, ages rapidly |

| Linkage Type | Deterministic + verified | Probabilistic guessing |

| Email Accuracy | Verified person-to-email | Deliverable ≠ correct person |

| Contact Freshness | Live-updated records | Stale from day one |

| Intent Reliability | Matched to verified IDs | Ghost record signals |

| Provenance Tracking | Full chain of custody | Unknown / unverifiable |

| Typical License | $250K–$5M/year | $50–$5K (you get what you pay for) |

| Cleaning Cost | Minimal (pre-cleaned) | Significant (30-50% of records) |